There’s a trader on Polymarket who’s been making serious money. Not by predicting outcomes. By being faster than everyone else.

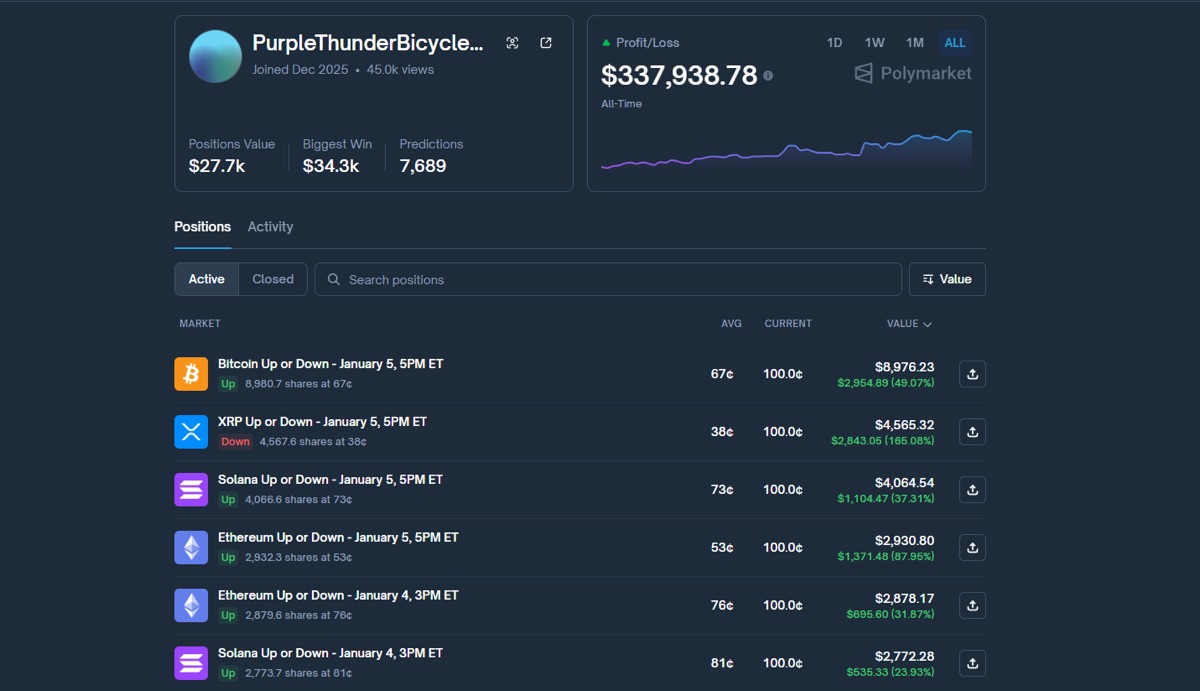

The numbers: over $300,000 in profits. Not over years. Over months. Using a strategy most people don’t even know exists.

Someone recently broke down exactly how it works. I’m going to explain it in plain English so you understand what’s actually happening.

This isn’t about whether Trump wins or Bitcoin hits $100K. It’s about capturing tiny price differences before anyone else can.

The Core Insight: Prices Don’t Update Instantly

Here’s something most people don’t realize about markets:

When news breaks, prices don’t adjust everywhere at the same time. There’s a delay. Maybe milliseconds. Maybe seconds. Sometimes even minutes.

In that window, there’s free money sitting on the table.

Let’s say news drops that changes the probability of some event from 50% to 70%. Instantly, anyone paying attention knows the “true” price should be around 70 cents.

But some traders haven’t seen the news yet. Some are slow to react. Some have orders sitting in the book from before the news.

If you can get to those stale orders before everyone else, you capture the difference.

How the Bot Actually Works

The bot that made $300K runs on simple logic (in concept, not in execution):

Step 1: Monitor everything

The bot watches multiple data sources simultaneously. News feeds. Twitter. Other prediction markets. Polymarket’s own orderbook. Anything that might signal a change in probability.

Step 2: Detect discrepancies

When something suggests the “fair” price should be different from the current market price, the bot flags it.

Step 3: Execute instantly

The bot doesn’t think. It doesn’t deliberate. It just acts. Send the order. Capture the edge. Move on.

Step 4: Manage inventory

The bot doesn’t want to hold big positions. It wants to scalp small profits repeatedly. So it’s constantly trying to flatten its book.

The Two Main Strategies Combined

Event-Driven Market Making

The bot sits in the orderbook, offering to buy slightly below fair value and sell slightly above. It collects the spread.

But here’s the key: it’s smart about when to be aggressive and when to pull back. When news is about to break (scheduled announcements, for example), it reduces exposure. When things are quiet, it gets more aggressive.

Cross-Market Arbitrage

Polymarket isn’t the only prediction market. There’s also Kalshi, PredictIt, and various other platforms.

Sometimes the same outcome is priced differently across platforms. If “Biden wins” is 45 cents on Polymarket and 50 cents on Kalshi, you buy on Polymarket and sell on Kalshi. Guaranteed profit regardless of who wins.

The bot monitors all platforms simultaneously and pounces when gaps appear.

Why Speed Matters So Much

In traditional arbitrage, you might have minutes or hours to execute. In modern markets, you have milliseconds.

The $300K bot uses:

- Low-latency infrastructure (servers physically close to Polymarket’s systems)

- Direct API connections (no going through web interfaces)

- Pre-computed order templates (no calculation delay when opportunities appear)

- Multiple execution paths (if one route is slow, use another)

Every millisecond of delay costs money. Someone faster will capture the opportunity first.

The Math Behind 1-2% Returns

Each individual trade might only make 1-2%. That sounds tiny until you see the volume.

Let’s say the bot makes 0.5% average per trade after fees. If it does 100 trades per day at $1,000 average size:

- 100 trades x $1,000 x 0.5% = $500/day

- $500 x 30 days = $15,000/month

- $15,000 x 12 months = $180,000/year

Now imagine better edge, bigger size, more trades. $300K becomes very achievable.

The key is consistency. The bot doesn’t swing for home runs. It consistently captures small edges at scale.

What Can Go Wrong

This isn’t free money. There are real risks:

Getting run over by news: Sometimes the bot gets stuck on the wrong side of a big move. It bought at 45 thinking it would sell at 47, but news breaks and the price crashes to 20. That’s a painful loss.

Adverse selection: If someone consistently sells to your bot, they might know something you don’t. You’re providing liquidity to informed traders and losing money.

Technical failures: If your bot goes down during a volatile moment, you’re exposed. If it has a bug and starts buying when it should sell, you’re destroyed.

Competition: Every successful strategy attracts competition. Spreads compress. Edge disappears. The $300K profit margin of 2025 might be $50K in 2026.

Can You Build Something Like This?

Honestly? It’s hard.

You need:

- Strong programming skills (Python minimum, probably need some C++ for speed)

- Understanding of market microstructure

- Capital to make it worthwhile ($50K+ to start seeing meaningful returns)

- Infrastructure (cloud servers, API access, monitoring systems)

- Time to iterate and improve

Most people who try to build trading bots lose money. The ones that work are the result of serious engineering and continuous improvement.

But here’s the thing: you don’t have to build the most sophisticated bot in the world. You just have to be better than the marginal trader.

Polymarket still has a lot of unsophisticated money flowing in. A reasonably good bot can still find edges.

A Simpler Alternative

If building bots isn’t your thing, you can still apply these concepts manually:

- Watch for news that should move markets

- Act fast when you see discrepancies

- Look for obvious mispricing across related markets

- Take many small positions instead of few large ones

You won’t capture every opportunity. But you can still make money if you’re disciplined and fast.

Learn Prediction Market Trading

Get the complete playbook for manual and automated trading on Polymarket, Kalshi, and other platforms.

Get the Course →The Bigger Picture

The $300K bot story isn’t just about one trader making money. It’s about what prediction markets have become.

These aren’t casual betting sites anymore. They’re becoming real financial markets with real liquidity and real professional traders.

That’s both opportunity and warning.

Opportunity because there’s still edge everywhere. The market is growing faster than the sophisticated players can absorb it.

Warning because this window won’t stay open forever. As more pros come in, the easy money disappears.

If you want to play in this world, now is the time to learn. Not next year. Now.