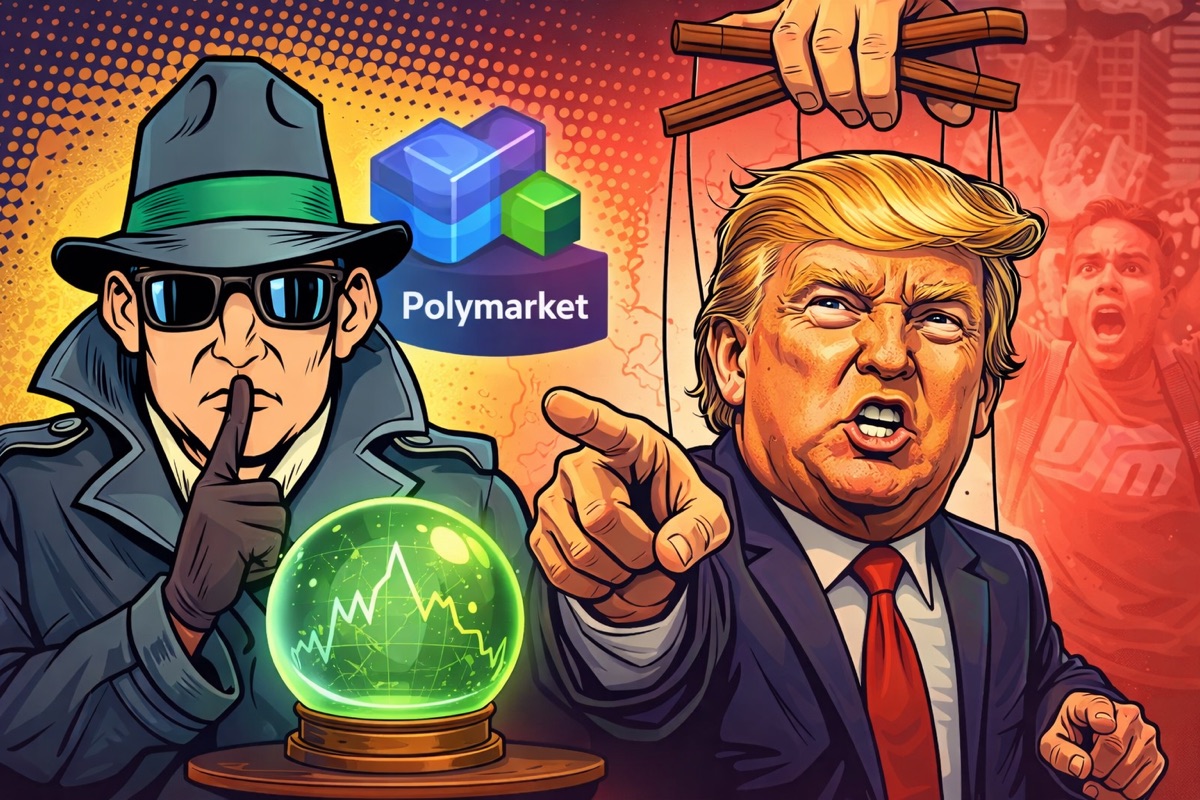

Prediction markets are supposed to be wisdom of crowds. Thousands of traders putting money where their mouth is, producing accurate probability estimates.

That’s the theory. The reality is messier.

Polymarket has manipulation. Wash trading. Coordinated pumps. And if you can’t spot these things, you’ll end up on the wrong side of trades.

Here’s how to protect yourself.

Why Manipulation Exists

Prediction markets are still relatively small compared to traditional financial markets. Lower liquidity means it takes less money to move prices.

On Polymarket specifically:

- Some markets have only a few hundred thousand dollars in liquidity

- A $50K-100K trade can move prices significantly

- There’s limited regulatory oversight compared to stock markets

- Pseudonymous trading makes it harder to track coordinated behavior

These conditions create opportunities for manipulation that wouldn’t exist on larger, more regulated markets.

Type 1: Whale Manipulation

The simplest form. Someone with significant capital moves a market to create a false impression.

What it looks like:

- Sudden large price move with no news

- Volume spike from a single or few wallets

- Price that doesn’t match fundamentals

- Often followed by gradual reversal as the whale exits

Why they do it:

- To attract attention to their preferred position

- To trigger stop losses from other traders

- To create “momentum” that retail traders follow

- Sometimes for non-trading reasons (political messaging)

How to spot it: Look at the wallet addresses doing the trading. On-chain data shows when a single entity is responsible for most of the volume. If one wallet is moving the market, be suspicious.

Type 2: Wash Trading

Wash trading is when someone trades with themselves to create fake volume and activity.

What it looks like:

- High volume but prices barely move

- Trades that perfectly offset each other

- Volume concentrated in quiet periods

- Same size trades repeating at regular intervals

Why they do it:

- To make a market look more liquid than it is

- To earn trading rewards or fee rebates

- To manipulate volume-based rankings

- To make their positions look more legitimate

How to spot it: Compare volume to price movement. Real trading moves prices. If a market shows huge volume but the price stays flat, something’s off. Also watch for repetitive trade patterns.

Type 3: Coordinated Campaigns

Groups of traders coordinate to move a market together, often through Discord, Telegram, or Twitter.

What it looks like:

- Sudden burst of buying from multiple new wallets

- Social media campaign promoting a specific position

- Lots of “look at these odds!” tweets at the same time

- New accounts promoting the position aggressively

Why they do it:

- To pump a position before dumping on latecomers

- To create social proof for a political narrative

- For the lulz (manipulation as entertainment)

How to spot it: Be skeptical of any position that’s suddenly getting heavy social media promotion. If everyone’s talking about how “obvious” a trade is, someone’s trying to find exit liquidity.

Type 4: Information Manipulation

Spreading false information to move prices, then trading against the resulting move.

What it looks like:

- Breaking “news” that can’t be verified

- Screenshots of sources that may be fake

- Rumors from “anonymous insiders”

- Quick price move followed by retraction/debunking

How to spot it: Verify everything. Don’t trade on unconfirmed information. Wait for multiple credible sources before believing breaking news. The few minutes you “lose” by waiting is worth avoiding manipulation.

Red Flags to Watch For

General warning signs that something’s not right:

- Price moves that don’t match any news

- Single wallets dominating volume

- Aggressive social media promotion

- Prices that seem obviously wrong but aren’t correcting

- Low liquidity markets with sudden interest

- Celebrity or influencer involvement

How to Protect Yourself

1. Verify information independently

Never trade based on a tweet or Discord message. Find the primary source. If you can’t verify it, don’t trade it.

2. Check on-chain data

Polymarket is on Polygon. All trades are visible. Services like Dune Analytics let you see who’s trading what. Use them.

3. Be skeptical of “obvious” trades

If something seems too good to be true, ask why. Why is this mispriced? Why hasn’t someone already corrected it?

4. Wait for liquidity

Trade in markets with real depth. Avoid tiny markets where small amounts can move prices.

5. Size appropriately

Even if you’re right, manipulation can temporarily move prices against you. Don’t position so large that you can’t handle temporary drawdowns.

Trade Smarter

Get the complete guide to navigating prediction markets safely and profitably.

Get the Course →The Bottom Line

Manipulation exists in all markets. Polymarket isn’t uniquely bad - it’s just smaller and newer, so manipulation is more visible.

The key is awareness. Once you know what to look for, you can avoid the traps and maybe even profit from them.

When prices move suspiciously, don’t panic. Don’t FOMO. Verify what’s actually happening. Trade based on fundamentals, not on price movements designed to manipulate you.

The crowd is wise, but only after the manipulators leave.