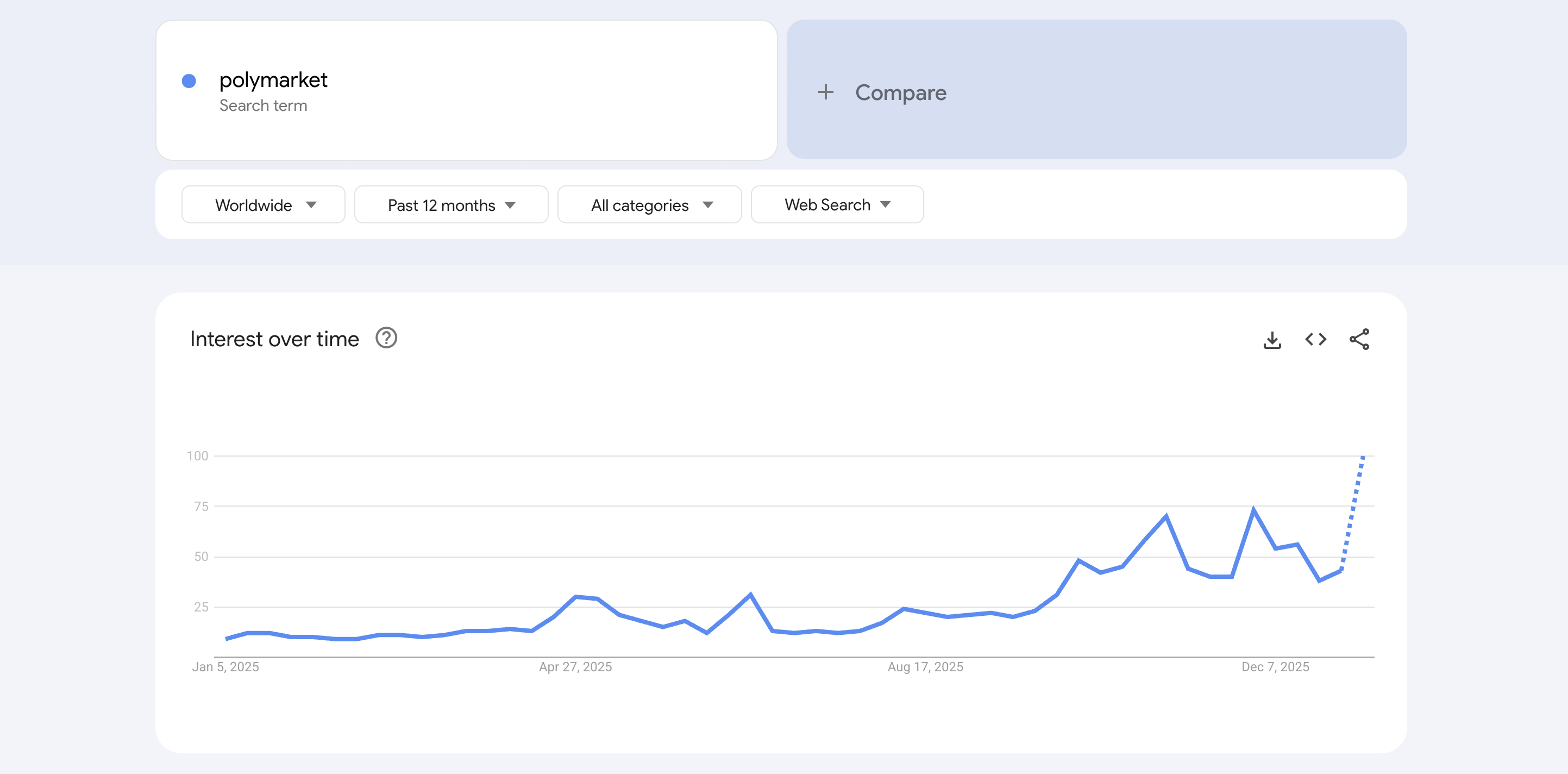

Polymarket just had its biggest week ever. $635 million in trading volume in the first three days of January. 450,000 monthly active users. CFTC approval in hand.

This isn’t some crypto degen playground anymore. Institutional money is flowing in. Google’s showing Polymarket odds directly in search results. The game has changed.

But here’s what most people get wrong: they treat Polymarket like sports betting. Pick a side, hope you’re right, collect if you win.

That’s one way to play. It’s not the best way.

The people actually making consistent money on Polymarket are using specific strategies that go way beyond “I think this will happen.”

Here are 7 that are working right now.

Strategy 1: The Information Edge Play

This is the simplest strategy and it still works. Find markets where you have genuine information the crowd doesn’t.

Not “I feel like Trump will do X” - actual information.

Examples that have worked:

- Industry insiders who know about product launches before announcements

- Journalists who understand how certain stories will develop

- Experts in specific fields where the average trader is clueless

The key is specificity. You’re not trying to know everything. You’re trying to know one thing better than everyone else.

I know someone who made consistent money on Fed rate decision markets because they actually read the Fed meeting minutes while everyone else just followed Twitter takes.

The alpha is in the details.

Strategy 2: Contrarian Fade on Overreactions

Markets overreact. Always have, always will.

When news breaks, prices swing hard. Then they usually settle back toward reality. This pattern is predictable enough to trade.

How it works:

- Big news hits

- Prices spike (or crash)

- Wait for the initial wave to pass

- Take the other side if the move seems overdone

This requires discipline. You need to actually wait for the overreaction before fading it. Trying to catch the falling knife while news is still developing is how you lose money.

The best setups are when there’s emotional reaction to news that doesn’t actually change underlying probabilities much. Political markets are great for this because people get tribal and emotional.

Strategy 3: Calendar Spread Arbitrage

Sometimes the same outcome is priced differently across related markets. This creates free money.

Example: Market A says “X happens by March” is 40 cents. Market B says “X happens by June” is 35 cents.

Wait, what? If it happens by March, it definitely happens by June. So June should be at least as expensive as March.

Buy June at 35, sell March at 40. You’ve locked in guaranteed profit regardless of what happens.

These opportunities exist because Polymarket has thousands of markets and not everyone is paying attention to every relationship between them.

Strategy 4: Late Information Markets

Some markets stay open even when the outcome is basically known. People just haven’t noticed yet.

This happens constantly with:

- Sports markets where injury news drops

- Political markets where votes have been counted in key areas

- Economic data markets after early indicators come out

The edge is speed. If you can systematically monitor news sources and react faster than the market, you capture free money.

Some people automate this with bots that watch specific news feeds and execute trades instantly. But even manual trading works if you’re focused.

Strategy 5: Market Making for Small Bettors

We talked about bots doing this at scale, but you can do it manually in less liquid markets.

Find a market with a wide spread. Maybe someone’s buying at 45 and selling at 55. You place orders at 47 to buy and 53 to sell.

If both orders get filled, you’ve made 6 cents risk-free (minus fees).

This works best in:

- Smaller markets with less competition

- Markets where the outcome is far away so there’s less urgency

- Markets you understand well enough to adjust if news breaks

The danger is getting stuck with a position when the market moves against you. So only do this in markets where you’d be okay holding the position anyway.

Strategy 6: The Volume Chaser

When a market suddenly gets hot, it usually keeps running for a while. Volume attracts volume.

Strategy:

- Monitor which markets are seeing unusual volume spikes

- When something goes from 10K daily volume to 100K, pay attention

- The first wave usually isn’t the last wave

This is basically momentum trading applied to prediction markets. It works because retail traders pile into whatever’s getting attention, pushing prices further.

The trick is getting in early enough and getting out before the music stops.

Strategy 7: The Portfolio Approach

Instead of betting big on single outcomes, spread across many uncorrelated markets where you have small edges.

If you have 10 positions and your edge is right 55% of the time, you’ll almost certainly make money over enough trades. Variance gets smoothed out.

How to implement:

- Never put more than 5-10% of your bankroll in any single market

- Diversify across categories (politics, sports, economics, entertainment)

- Track your actual hit rate over time

- Cut position sizes when you’re running bad, increase when running good

This is how professional bettors have always operated. The edge per bet is small. The money is made through volume and discipline.

What All These Strategies Have in Common

Notice something? None of these are “I think Biden/Trump will win” plays.

The best strategies all involve:

- Systematic edges that repeat

- Risk management baked in

- Less dependence on being “right” about outcomes

- More focus on process over prediction

Prediction markets reward good process, not lucky guesses.

Master Prediction Market Trading

Get the full playbook with advanced strategies, risk management, and real trade examples.

Get the Course →Getting Started

If you’re new to Polymarket:

Week 1: Just watch. Don’t trade. Understand how prices move, how volume flows, how news affects markets.

Week 2: Start with tiny positions. $50 max per market. You’re paying tuition to learn.

Week 3-4: Pick ONE strategy from this list. Focus only on that. Track every trade.

Month 2+: Scale what’s working. Drop what isn’t. Add complexity slowly.

The biggest mistake people make is trying to do everything at once. Pick one approach, master it, then expand.

The Opportunity Window

Prediction markets are still early. Most people don’t know they exist. The money flowing in is still a fraction of sports betting or stock trading.

That means edges are bigger than they should be. Spreads are wider. Inefficiencies are more common.

This won’t last forever. As more money comes in, markets get more efficient. The easy opportunities disappear.

If you’re reading this in January 2026, you’re still early. Not as early as 2024, but early enough that the strategies above still work.

The question is: are you going to watch from the sidelines, or are you going to learn to play?