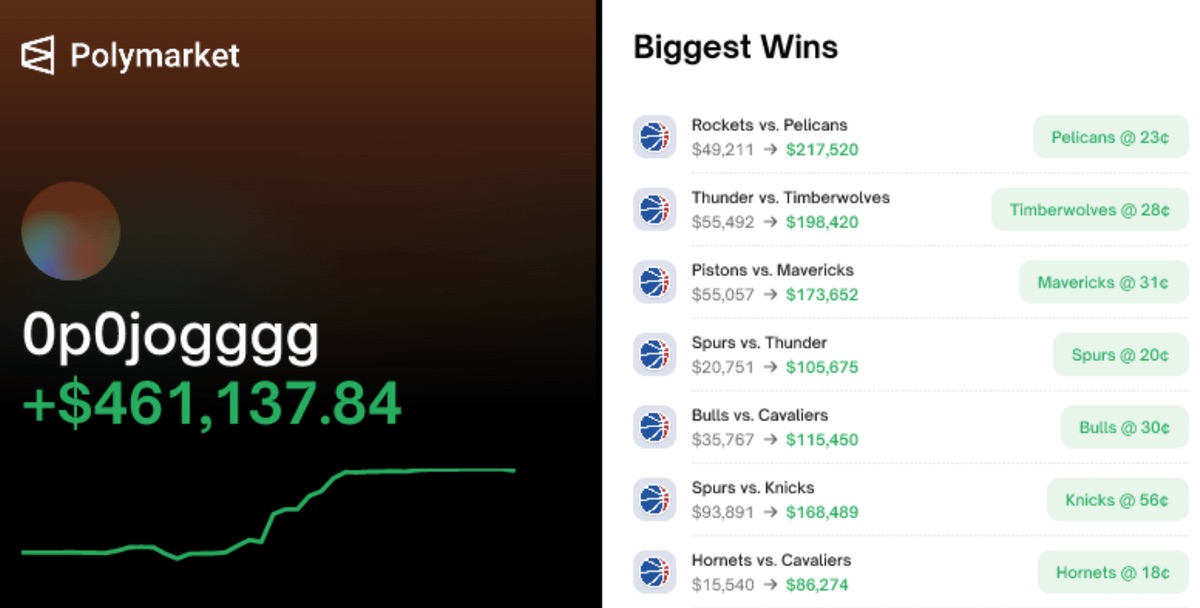

Yesterday someone posted their Polymarket bot stats on Twitter. 54 trades triggered. 54 wins. Zero losses.

Not paper trading. Not backtesting. Real money, real trades, real results.

The kicker? Each trade was generating about 1.5% returns. Sounds small until you do the math on 54 consecutive wins.

So what’s actually going on here? Is this legit? And more importantly - can you do something similar?

Let’s break it down.

First, What This Bot Isn’t Doing

This isn’t some AI predicting election outcomes or sports results better than the crowd. That’s a losing game for bots because humans actually have information edges on event outcomes.

This bot doesn’t care who wins. It doesn’t predict anything. It just exploits mechanical inefficiencies in how the market works.

Think of it like this: the bot isn’t trying to be smarter than everyone else about what will happen. It’s trying to be faster than everyone else at reacting to what just happened.

The Core Strategy: Market Making + Micro-Arbitrage

The bot runs two parallel strategies:

Strategy 1: Market Making

When there’s a spread between buy and sell prices, the bot sits in the middle. Someone wants to buy at 52 cents, someone wants to sell at 48 cents. The bot offers to buy at 49 and sell at 51.

Small margin on each trade. But with enough volume, it adds up fast.

Strategy 2: Micro-Arbitrage

When news breaks or odds shift on one platform, there’s usually a few seconds (sometimes minutes) where prices haven’t fully adjusted everywhere.

The bot watches for these gaps and captures them before humans can react.

Why 1.5% Per Trade Matters

Most people see 1.5% and think it’s nothing. Here’s why they’re wrong:

If you compound 1.5% over 54 trades, your money more than doubles. That’s with zero losses.

But more importantly, the risk profile is completely different from betting on outcomes. When you’re market making, you’re not exposed to the binary “right or wrong” risk of prediction markets.

You’re just capturing spread. The event outcome doesn’t matter to you.

What You Need to Run Something Like This

Let’s be real about requirements:

Technical skills: You need to write code that connects to Polymarket’s API, monitors orderbooks in real-time, and executes trades in milliseconds. The guy who built this bot said he “coded the logic himself.”

Capital: Market making works on volume. You need enough capital to place meaningful orders and capture enough spread to matter. We’re talking at least $10K to make it worthwhile, realistically $50K+ for serious returns.

Infrastructure: Speed matters. You need low-latency connections, probably a VPS near Polymarket’s servers, and systems that don’t go down.

Understanding of market microstructure: You need to know how orderbooks work, how spreads form, and how to avoid getting picked off by faster traders.

The Risks Nobody Talks About

54-0 sounds amazing. Here’s what could go wrong:

Adverse selection: Sometimes you get filled on your orders specifically because someone knows something you don’t. You buy at 49 thinking you’ll sell at 51, but the price crashes to 30 because news just broke.

Inventory risk: If you end up holding a position you can’t exit, you’re now exposed to outcome risk whether you wanted it or not.

Competition: Every time someone tweets about a winning bot strategy, more people pile in. Spreads compress. Alpha disappears.

Platform risk: Polymarket can change their API, adjust fees, or ban automated trading entirely. Your bot could stop working overnight.

Is This Still Possible in 2026?

Yes, but the window is narrowing.

Prediction markets just hit mainstream. Polymarket did $635 million in volume in the first three days of January alone. That’s insane liquidity compared to even a year ago.

More liquidity means more opportunities for market makers. But it also means more competition from sophisticated traders who’ve been doing this for years in traditional markets.

The edge is still there. It’s just smaller than it was, and you need to be better to capture it.

What You Should Actually Do

If you’re serious about this:

Start by watching. Open Polymarket. Watch how orderbooks move. See how prices react to news. Understand the rhythm before you try to trade it.

Learn the API. Polymarket has documentation. Build something simple first - maybe just a script that monitors prices. Don’t start with a full trading bot.

Paper trade your strategy. Before you put real money in, run your logic against historical data. See how it would have performed.

Start small. When you go live, use position sizes that won’t kill you if everything goes wrong. Scale up only after you’ve proven the strategy works with real money.

Want to Learn Prediction Market Trading?

Get the complete playbook for Polymarket, Kalshi, and other prediction platforms.

Get the Course →The Bottom Line

54 consecutive wins isn’t magic. It’s a well-designed system exploiting a specific edge in market microstructure.

Can you replicate it? Maybe. But you need technical skills, capital, and a deep understanding of how these markets actually work.

The opportunity is real. Prediction markets are exploding and there’s alpha everywhere right now. But the window won’t stay open forever.

The people making money aren’t the ones watching from the sidelines. They’re the ones building systems and putting them to work.